what is cibil score

what is cibil score CIBIL (Credit Information Bureau (India) Limited) score is a three-digit numeric summary of a person’s creditworthiness based on their credit history. It is based on an individual’s credit behavior and payment history with respect to loans and credit cards.

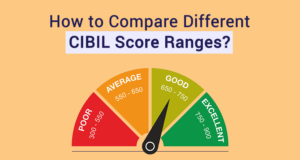

The CIBIL score ranges from 300 to 900, with a higher score indicating a higher creditworthiness. A score of 750 or above is considered good and increases the chances of getting credit approved with favorable terms and interest rates.

Banks and other financial institutions use the CIBIL score as one of the key factors in evaluating an individual’s creditworthiness and ability to repay loans. Hence, maintaining a good CIBIL score is important for securing credit and financial stability.

CIBIL Score: What it is and Why it Matters

In today’s world, credit has become an essential aspect of our financial lives. From buying a car or a house to paying for education or starting a business, credit is an integral part of achieving our financial goals. To access credit, we need to have a good credit history, and a CIBIL score is one such metric that measures our creditworthiness. In this article, we will discuss what a CIBIL score is, how it is calculated, why it matters, and how to improve it.

What is a CIBIL score?

A CIBIL score is a three-digit number that ranges from 300 to 900 and is generated by the Credit Information Bureau (India) Limited (CIBIL). It is a measure of a person’s creditworthiness, and it is based on their credit history. The CIBIL score is calculated using a person’s credit history, which includes their credit utilization, repayment history, length of credit history, and credit mix.

How is a CIBIL score calculated?

The CIBIL score is calculated using a complex algorithm that takes into account a person’s credit history. The factors that impact a CIBIL score include:

- Credit Utilization: This is the percentage of credit that a person has used compared to the total available credit limit. A high credit utilization ratio indicates that a person is relying heavily on credit, which can negatively impact their score.

- Repayment History: This is a record of a person’s past repayment behavior. Timely repayment of credit card bills and loan EMIs is crucial in maintaining a good credit score.

- Length of Credit History: This is the duration of a person’s credit history. A longer credit history shows that a person has been using credit responsibly for an extended period.

- Credit Mix: This refers to the different types of credit that a person has availed, such as credit cards, personal loans, and home loans. A healthy mix of credit types is considered positive.

- Credit Inquiries: This refers to the number of times a person has applied for credit. Multiple inquiries within a short period can lower a person’s credit score.

Why does a CIBIL score matter?

A CIBIL score is an important metric that lenders use to assess a person’s creditworthiness. A good credit score indicates that a person is a low-risk borrower and has a high probability of repaying their loans on time. A low credit score, on the other hand, indicates that a person is a high-risk borrower and may default on their loan payments. Hence, maintaining a good CIBIL score is crucial in securing credit and getting favorable terms and interest rates.

How to improve your CIBIL score?

If your CIBIL score is not up to the mark, don’t worry. There are several steps that you can take to improve your score.

- Pay your bills on time: Late payments or defaulting on loan payments can significantly impact your CIBIL score. Hence, make sure that you pay your bills on time, every time.

- Keep your credit utilization low: A high credit utilization ratio indicates that you are relying heavily on credit, which can negatively impact your CIBIL score. Hence, keep your credit utilization low.

- Maintain a healthy credit mix: Having a mix of secured and unsecured credit, such as home loans, personal loans, and credit cards, is considered positive.

- Monitor your credit report regularly:

- Credit Information Bureau (India) Limited (CIBIL) score is a crucial factor that determines your creditworthiness when it comes to getting a loan or credit card. It is a three-digit number that ranges from 300 to 900, with 900 being the highest score. CIBIL score is calculated based on various factors such as payment history, credit utilization, credit mix, and length of credit history. In this article, we will discuss the importance of CIBIL score and how to maintain a good CIBIL score.

Importance of CIBIL Score

CIBIL score is one of the most important factors that lenders consider when evaluating a loan or credit card application. A good CIBIL score can increase your chances of getting approved for a loan or credit card with favorable terms and interest rates. A poor CIBIL score, on the other hand, can lead to rejection of your loan or credit card application or approval with higher interest rates.

Apart from loan and credit card applications, CIBIL score is also used by landlords, insurance companies, and employers to evaluate an individual’s creditworthiness. For instance, landlords may check CIBIL score before renting out a property to ensure that the tenant is financially stable and responsible. Similarly, insurance companies may use CIBIL score to determine the premium rates for insurance policies. Employers may also check CIBIL score during the hiring process to assess an individual’s financial responsibility.

Factors that Affect CIBIL Score

As mentioned earlier, CIBIL score is calculated based on various factors such as payment history, credit utilization, credit mix, and length of credit history. Let’s take a closer look at each of these factors.

- Payment history: Payment history is one of the most important factors that affect CIBIL score. Late payments, defaults, and settlements can negatively impact your score. It is important to pay your credit card bills and loan EMIs on time to maintain a good payment history.

- Credit utilization: Credit utilization refers to the percentage of your credit limit that you use. Using a high percentage of your credit limit can indicate that you are credit-hungry and may not be able to manage your finances well. It is advisable to keep your credit utilization below 30% to maintain a good CIBIL score.

- Credit mix: Credit mix refers to the types of credit that you have such as secured loans (home loans, car loans) and unsecured loans (personal loans, credit cards). Having a healthy mix of secured and unsecured loans can positively impact your CIBIL score.

- Length of credit history: Length of credit history refers to the duration of your credit accounts. A longer credit history indicates that you have been responsible with credit and can positively impact your CIBIL score.

How to Maintain a Good CIBIL Score

Maintaining a good CIBIL score requires discipline and financial responsibility. Here are some tips to maintain a good CIBIL score:

- Pay your bills on time: Late payments can have a negative impact on your CIBIL score. It is important to pay your credit card bills and loan EMIs on time to maintain a good payment history.

- Keep your credit utilization low: As mentioned earlier, keeping your credit utilization below 30% can positively impact your CIBIL score. It is important to use your credit cards responsibly and not exceed your credit limit.

- Monitor your credit report regularly: It is important to monitor your credit report regularly to ensure that there are no errors or fraudulent activities. You can get a free credit report from CIBIL once a year.

- Maintain a healthy credit mix: Having a healthy mix of secured and unsecured loans can positively impact your CIBIL score. However,